April 2020 Auto Industry Data Point to Rapid Deterioration of the Market

Automotive production at the end of March had fallen by one-third according to several measures. This decline was outpaced by a near 50% reduction in demand as measured by unit sales. April’s data reported a near complete shutdown of vehicle production across the country.

Automotive industry data for April of 2020 pointed to a rapid deterioration of the automotive market. All measures of the market pointed to a severe and rapid contraction in both demand and production. April data indicate that production came to a near standstill with production at less than 5% of previous levels. Vehicle sales on an annualized basis fell from over 17M as recently as February to 8.8M.

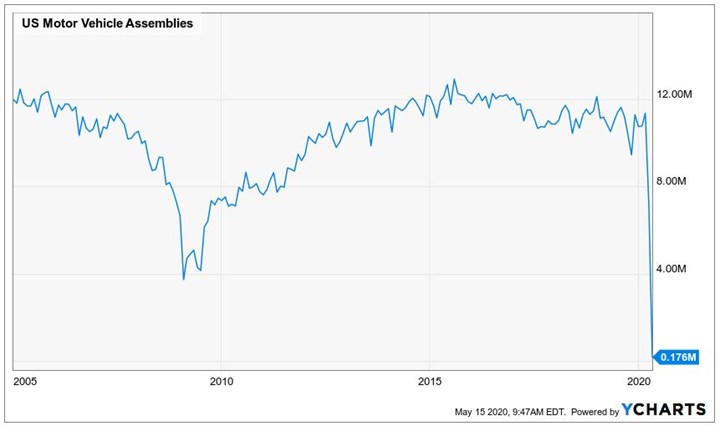

PRODUCTION:

Data released on May 15th and representing April’s activity, reported a 96% decrease in automotive industrial production and a 98% decrease in US Motor Vehicle Assemblies. Rail traffic of automotive parts as of May 9th was also down 87%. This virtual shutdown of the industry does not measure the true production of these facilities as some would have converted a portion of their operations over to the production of the equipment needed for countering COVID-19.

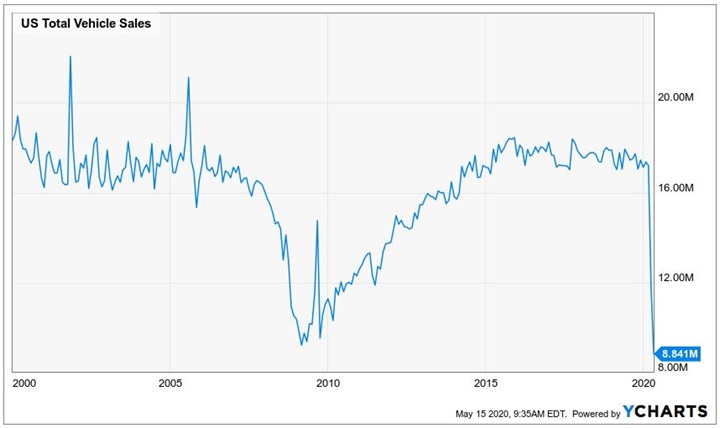

DEMAND:

Total April vehicle sales fell 49% to 8.84M vehicles sold on an annualized basis. In contrast, data reported as recently as February reported sales at an annualized rate of 17.2M vehicles.

April’s actual vehicles sales will not be released until late May; however, a look at March’s single-month sales in 2019 vs 2020 indicated a 62% reduction. If the same decline were applied to April’s 2019 results then sales for this April were approximately 850,000 vehicles.

A silver-lining in all of this is that sales of even 800,000 vehicles in April would represent a decrease in inventories by over 600,000 vehicles. This may be welcomed news to those monitoring the US Domestic Inventory to Sales ratio which increased in March by almost 50% to a level of 2.8 from 1.9 in February. A sharp reduction in inventories over the coming months may help the industry get back up and running in the future, much will depend on consumer sentiment.

.jpg;width=70;height=70;mode=crop)