Real 10-Year Treasury Rate Remained Strongly Negative in August

The year-over-year change in the real 10-year Treasury, now -331 basis points, was slightly less negative for the second month in a row. However, the change was still quite negative and indicating further expansion in manufacturing.

In August, the nominal 10-year Treasury rate was 1.28%, which was the lowest rate since February. Of course, historically, the current rate is extremely low. The average 10-year Treasury rate since April 1953 was 5.92%, which hasn’t been seen since July 2000. So, nearly two decades below average tells you that the rate prior to July 2000 was well above average.

As the real 10-year Treasury rate is the nominal rate minus the inflation rate, the real 10-year Treasury rate was -3.97% in August, which was just 8 basis points higher than last month. While the nominal 10-year Treasury rate was down slightly, the real 10-year Treasury rate was slightly less negative due to a very slight decrease in the rate of inflation. Instead of pushing nominal rates into negative territory, the Fed is using higher inflation to make real rates negative. This is very stimulative to the economy.

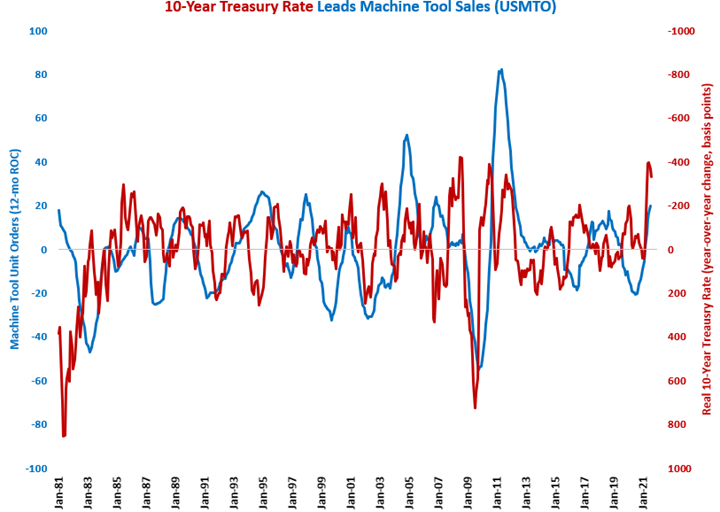

The year-over-year change in the real 10-year Treasury, now -331 basis points, was slightly less negative for the second month in a row. However, the change was still quite negative and indicating further expansion in manufacturing.

As much as the absolute level of interest rates, it is the relative change in interest rates that drives additional borrowing and spending. A rising change in the real 10-year Treasury rate tends to be a negative signal for durable goods manufacturing. Rising changes in the real 10-year Treasury rate tend to lead to contraction in durable goods new orders and capital equipment consumption by a relatively long period of time – historically, between 12 and 24 months. The rising change in the 10-year Treasury rate is a good leading indicator of future contraction in housing permits, construction spending and consumer durable goods spending as well.

.JPG;width=70;height=70;mode=crop)