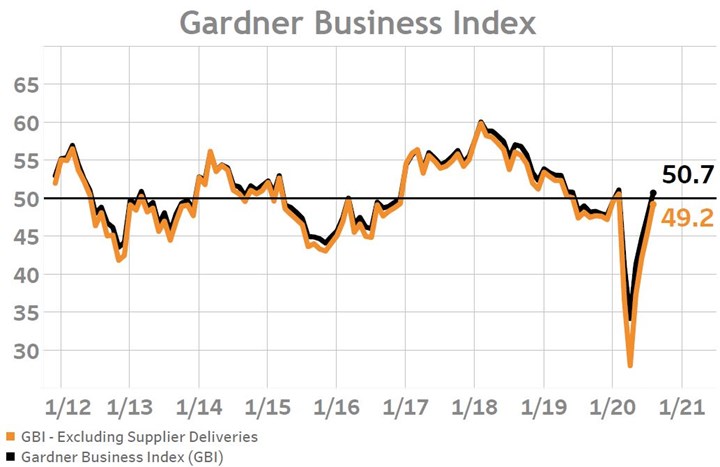

August Business Index Breaks Through into Expansionary Territory

Excluding the impact of supplier deliveries, the Gardner Business Index would have registered 49.2 as opposed to an expansionary 50.7 reading. Expanding new orders and production activity in August is highly encouraging because these measures have historically acted as a bellwether for the overall index.

The Gardner Business Index closed August at 50.7, marking its first expansionary reading since February 2020 and COVID’s initial disruption of the world economy. Readings above a level of 50 indicate expanding business activity. The further above 50 a reading is the faster business activity is expanding compared to the prior month. Of the six components which constitute the Index three reported expanding activity, these were led by supplier deliveries which was followed by production and new orders. In a post-COVID first, production and new orders both reported their first month of expansionary activity. As explained in our previous reports, COVID-period readings of supplier delivery activity have been abnormally high because of disruptions to supply chains as opposed to growing supply chain backlogs, thanks to strong economic growth. Of the remaining components of the Index, employment activity reported almost no change compared to the prior month and was followed by exports and backlogs, both of which extended their slowing contraction trends.

As previously reported, COVID’s disruption to the economy has substantially elevated supplier delivery readings since February. Removing the influence of supplier deliveries from the overall Index reading would lower the latest reading to 49.2 and mark the fourth consecutive month of rising Index readings below 50. Rising readings that are below ‘50’ signal slowing contraction in business activity.

Excluding the impact of supplier deliveries, the Gardner Business Index would have registered 49.2 as opposed to an expansionary 50.7 reading. Expanding new orders and production activity in August is highly encouraging because these measures have historically acted as a bellwether for the overall index.

The overall rebound in manufacturing business activity has resulted in a growing number of end-markets reporting expanding business activity. Among those are petrochemicals — one of the hardest-hit industries earlier in the year — which reported the greatest level of expansion during August. It was followed by other expanding end-markets including plastic custom processing, automotive and metal form-fabrication. Conversely, both the industrial motors and aerospace markets continue to report contracting activity.

By company size, firms of between 100 and 250 employees reported the fastest expansion in business activity during August followed distantly by firms over 250 employees in size. Survey responses from smaller firms indicate that business conditions are less favorable. Firms of between 20 and 49 employees reported nearly unchanged business conditions from the prior month while firms under 20 employees in size registered their 4th month of slowing contraction. The last time that firms in this category reported expanding activity was June 2019.

Gardner Intelligence does its utmost to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to tell us how your businesses are faring. Only through your participation are we able to assess the current industry and see where it is heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.

.jpg;width=70;height=70;mode=crop)