Cutting Tool Orders Improving

While June’s rate of contraction was still a fast rate of month-over-month contraction, it was a slower rate of contraction than the previous two months.

In June 2020, real cutting tool orders were $150.6 million, which was the highest order total since the beginning of the pandemic. This is an encouraging sign that durable goods manufacturing is recovering. Compared with one year ago, cutting tool orders contracted -25.3%, which was the 16th consecutive month of month-over-month contraction. While this was still a fast rate of month-over-month contraction, it was a slower rate of contraction than the previous two months.

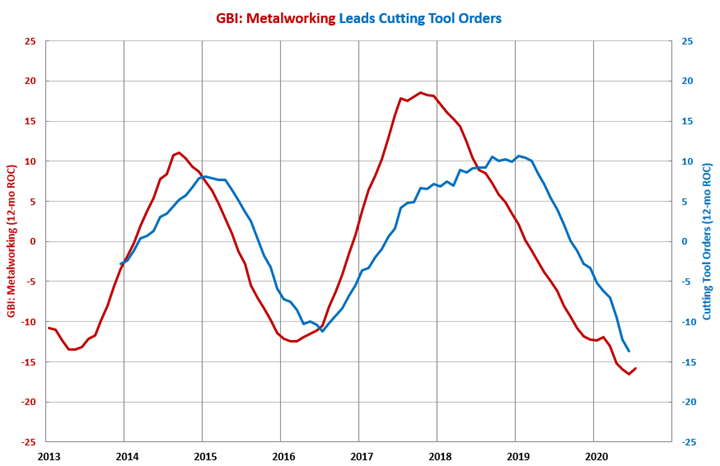

The annual rate of change contracted at an accelerating rate for the ninth month. The annual rate of contraction was 13.7%, which was the fastest rate of annual contraction since the data was made public. At the beginning of 2020, the Gardner Business Index: Metalworking indicated that the annual rate of contraction in cutting tool orders would bottom out in the summer of 2020. However, the pandemic accelerated the contraction in metalworking and extended the accelerating contraction in cutting tool orders.

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. The annual rate of change in the Index has contracted for 17 straight months, clearly indicating that the annual rate of contraction in cutting tool orders will continue to accelerate. However, the annual rate of contraction decelerated in July. If this is a bottom in the rate of change in the GBI: Metalworking, then a bottom in the rate of change in cutting tool orders likely will happen before the end of 2020.

.JPG;width=70;height=70;mode=crop)