Disposable Income Growth Above Average for 5th Month

While disposable income growth was above its historic average rate, a significantly higher proportion of income was still coming from government transfer payments.

In August, real disposable income was $15,499 billion. This was the fourth straight month that the level of real disposable income declined. This is extremely unusual historically, but it is a direct result of the initial round of stimulus checks and extended unemployment benefits during the early months of the pandemic. Also, August income was 3.9% more than one year ago, which was faster month-over-month growth than the historic average. However, the one-month rate of growth decelerated for the fourth consecutive month.

All of the above is due to government transfer payments such as expanded unemployment insurance and government stimulus checks. Government transfer payments have accounted for at least 36% of all income in April. Prior to April, government transfer payments accounted for no more than 27% of income.

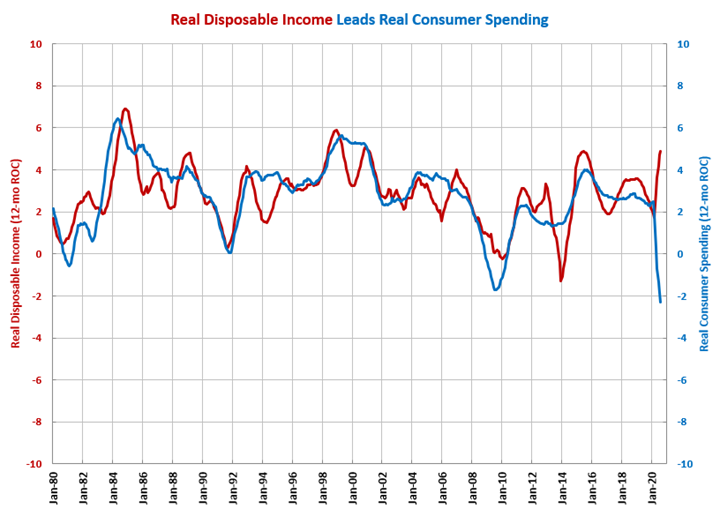

The annual rate of growth accelerated to 4.9%. This was the fastest rate of annual growth since January 2001. Normally, this kind of acceleration would lead to a dramatic increase in consumer spending. While the increased government transfer payments may have helped support consumer spending, the question is what happens to consumer spending when those payments end.

.JPG;width=70;height=70;mode=crop)