Durable Goods Orders Contracting Slower in September

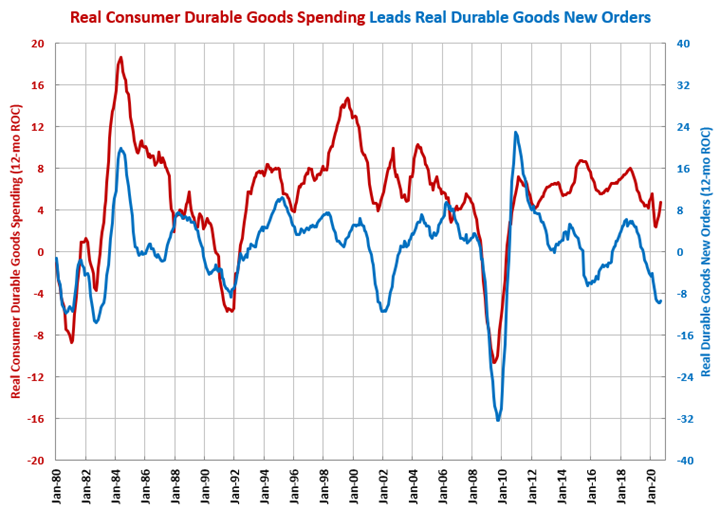

Consumer durable goods spending is growing extremely fast and indicating a bottom in the rate of contraction in durable goods new orders has occurred.

New orders for real durable goods totaled $248,680 million in September. This was 1.2% less than one year ago and the slowest rate of contraction since July 2019.

The result was that the annual rate of change contracted 9.4%, which was the first month of decelerating contraction this cycle. Consumer durable goods spending is growing extremely fast and indicating a bottom in the rate of contraction in durable goods new orders has occurred.

It’s important to note that aerospace orders in August were negative for the fifth time in six months and non-defense aerospace orders were negative for the sixth consecutive month.

Accelerating Growth: appliances, computers/electronics, ship/boat building

Decelerating Growth:

Accelerating Contraction: aerospace, fabricated metal products, power generation

Decelerating Contraction: construction materials, durable goods, HVAC, machinery/equipment, motor vehicle/parts, off-road/construction machinery, oil/gas-field/mining machinery, primary metals, total capital goods

.JPG;width=70;height=70;mode=crop)