Durable Goods Production at Highest Level Since February

Compared with one year ago, the index contracted 8.1%, which was the fourth month in a row that the month-over-month rate of change in the index decelerated and the slowest rate of contraction since February.

In August, the index for production of durable goods was 101.2, which was the highest level for the index since February. Compared with one year ago, the index contracted 8.1%, which was the fourth month in a row that the month-over-month rate of change in the index decelerated and the slowest rate of contraction since February.

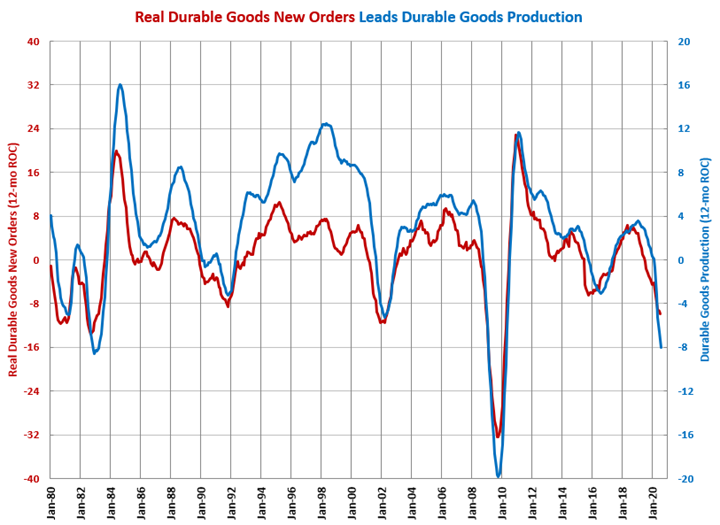

The annual rate of change, which is easier to correlate with other data points, contracted 8.0% this month. This was the sixth consecutive month of accelerating contraction. The key leading indicator of production—durable goods new orders—is starting to bottom out and indicating that production should do the same soon. Also, consumer durable goods spending, which leads durable goods new orders, reached an all-time high in July and appeared to be at a bottom and about to start contracting at a slower rate.

We track industrial production and its leading indicators for a number of industries.

Accelerating Growth: electronics/computers

Decelerating Growth: military

Accelerating Contraction: aerospace, automotive, construction materials, custom processors, durable goods, forming/fabricating (non-auto), furniture, hardware, HVAC, industrial motors/hydraulics/mechanical components, machinery/equipment, medical, metalcutting job shops, oil/gas-field/mining machinery, petrochemical processors, plastic/rubber products, power generation, primary metals, printing, pumps/valves/plumbing products, ship/boat building, textiles/clothing/leather goods, wood/paper products

Decelerating Contraction: appliances, food/beverage processing, off-road/construction machinery

.JPG;width=70;height=70;mode=crop)