February Production Down Due to Supply Chain Disruption and Winter Storm

February industrial production contracted 3.8%. The contraction accelerated because of the winter storm in Texas and other parts of the midwest hindered production and significant supply chain disruption, particularly regarding computer chips, forced a number of manufacturers to slow or stop production.

In February, the index for production of durable goods was 104.1. Compared with one year ago, the index contracted 3.8%, which was the first significant acceleration in contraction since the economy was locked down almost one year ago. Although, there were some extenuating circumstances in February. First, the winter storm in Texas and other parts of the midwest hindered production. Second, significant supply chain disruption, particularly regarding computer chips, forced a number of manufacturers to slow or stop production. One positive is that aerospace production grew for the first time since December 2019.

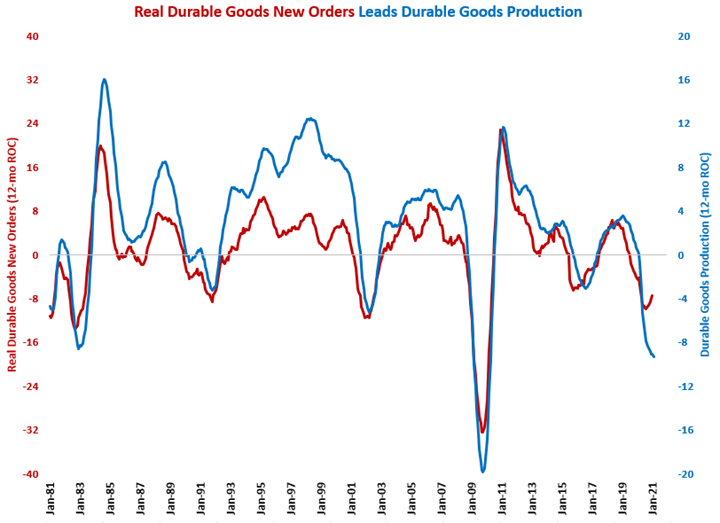

The annual rate of change, which is easier to correlate with other data points, contracted 9.4%. This was the 12th consecutive month of accelerating contraction. The key leading indicator of production – durable goods new orders – has bottomed out, according to its rate of change, and is indicating that production should do the same soon. Also, consumer durable goods spending, which leads durable goods new orders, grew more than 11% from June to November 2020, 9.5% in December 2020, and 16% in January. This seemingly means production needs to increase significantly to keep from eating too far into inventories.

We track industrial production and its leading indicators for a number of industries.

Accelerating Growth: appliances, HVAC

Decelerating Growth: electronics/computers

Accelerating Contraction: automotive, construction materials, durable goods, forming/fabricating (non-auto), furniture, metalcutting job shops, military, oil/gas-field/mining machinery, petrochemical processors, plastic/rubber products, primary metals, printing, pumps/valves/plumbing products, ship/boat building, textiles/clothing/leather goods, wood/paper products

Decelerating Contraction: aerospace, custom processors, food/beverage processing, hardware, industrial motors/hydraulics/mechanical components, machinery/equipment, medical, off-road/construction machinery, power generation

.JPG;width=70;height=70;mode=crop)