Fed Virtually Assures Borrowing Costs to Rise in 2022 In Latest Meeting

The latest meeting of the Federal Reserve Banks ended December 15th, 2021. In this latest meeting Bank presidents made decisive decisions designed to combat rising inflation. These actions will also ultimately result in higher borrowing costs for manufacturers.

Eight times each calendar year a committee of Federal Reserve Bank presidents, including the seven member Board of Governors, meet to determine economic policy. This collective is called the Federal Open Market Committee or “FOMC”. As stated on the Federal Reserve’s website, “the Committee reviews economic and financial conditions, determines the appropriate stance of monetary policy, and assesses the risks to its long-run goals of price stability and sustainable economic growth”. The latest meeting recently concluded on December 15th, 2021.

In its latest meeting the FOMC significantly changed their inflation projections for the worse, increasing projected CY2021 inflation as measured using the personal consumption expenditure (PCE) method from 3.7% to 4.4%. For 2022 the committee now believes that inflation will rise to 2.6% from 2.2%. However, the Federal Reserve (the “FED”) has been slow to respond to rising inflation and until only very recently had signaled that they believed inflation would be “transitory”. The use of this word, many believed, was code for ‘short-lived’ and thus not requiring a significant response by the FED or policy change. Now that PCE inflation is at 5.3%* and an alternative measure of inflation, the Consumer Price Index (CPI) is at nearly 7%, The FOMC’s messaging and anticipated actions are now changing to better address recent inflationary risks, but they will certainly come at the cost of slowing the economy.

The latest policy statement released on December 15th (now available at: https://www.federalreserve.gov/newsevents/pressreleases/monetary20211215a.htm) illustrated in Figure 2 that a significant number FED leaders believe that the Fed Funds Rate (FFR), should be increased from its effective rate of 0.125% to 0.875% in 2022 while two members indicated and even higher rate of 1.125%. This is important to manufacturers as an increase in the FFR will ripple through the financial system in the form of higher borrowing and refinance rates.

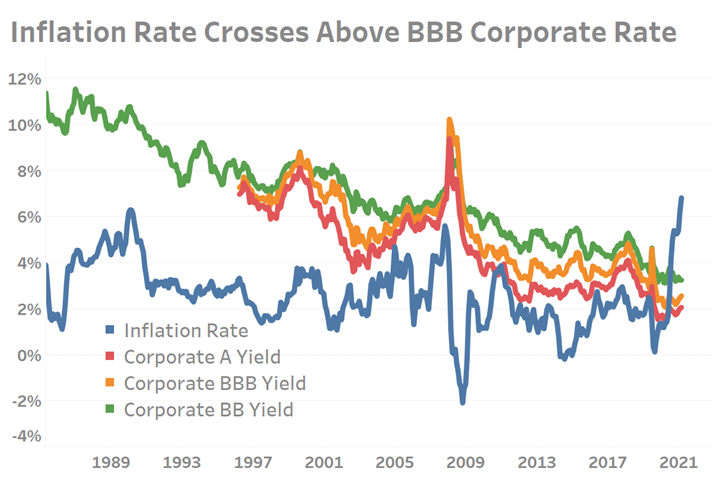

The rapid rise in inflation has resulted in many firms being able to borrow at negative interest rates.

While it is nearly certain that manufacturers will experiencing rising financing costs in 2022, and likely beyond, the manufacturing industry actually has been deleveraging since at least mid-2020. Long-term debt held by manufacturers through 3Q2021 stood at $505 Billion which is comparable to the same amount of debt held in 2016, down from a peak of $587 Billion just before the pandemic. Short-term debt defined at that held for less than 1-year has also fallen comparably since the pandemic.

How Manufacturers Can Make These Data Actionable:

To the degree that manufacturers know their cashflow needs for the coming year —whether it be for inventory control or capital equipment— interest rates will certainly not be moving lower anytime in the foreseeable future and certainly not in the next 12-18 months. Manufacturers who know they will need to borrow capital in the near-term many want to work with their lenders to lock-in rates soon before they rise, potentially by several percentage points. As Gardner Intelligence has previously reported, borrowing rates are presently well below recent measures of inflation; an event which has not happened in decades and will not last.

* Measured on a quarterly basis at a seasonally adjusted annual rate or “SAAR”.

.jpg;width=70;height=70;mode=crop)