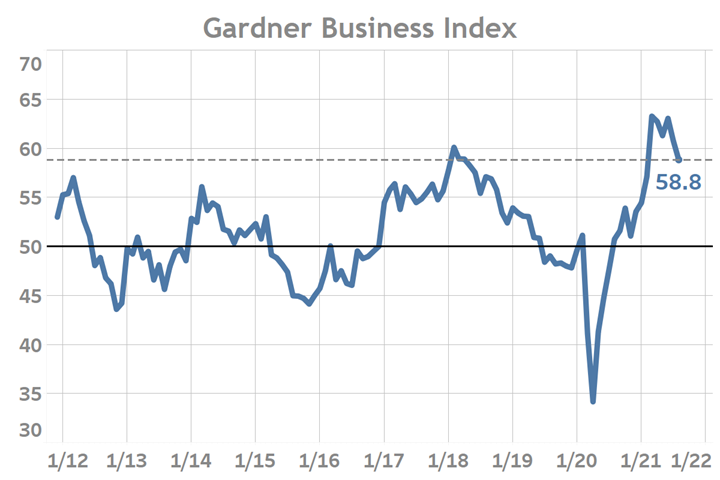

Gardner Business Index - August 2021

The Gardner Business Index (GBI) ended August at 58.8, marking the second consecutive month in which the overall Index moved lower.

The Gardner Business Index (GBI) ended August at 58.8, marking the second consecutive month in which the overall Index moved lower. Every measure of business activity moved lower in absolute terms during the month with slowing expansion reported for new orders, production, employment, and backlogs. The reading for supplier deliveries —which proxies for the timeliness of order-to-fulfillments— reported a smaller proportion of manufacturers experiencing worsening delivery times for a second consecutive month. This is the first time that back-to-back supplier delivery readings have fallen since June 2020. Despite the consecutive months of decline, the latest reading is only slightly more than 3-points below the all-time high posted in June 2021. Compared to pre-COVID levels, the latest delivery reading is almost 17-points above the high of 2018, indicative of the still extreme conditions facing supply chains.

Gardner Business Index through August 2021

Historically production activity readings have slightly exceeded those of new orders. However, August marked the seventh sequential month in which the reading for production activity was less than or equal to that of new orders. Gardner believes that this is evidence of the on-going challenges facing supply chains which are taking a worsening toll on production up to and including line stoppages. The knock-on effects from this may be appearing in the employment (hiring) readings which could be falling because of both a tight jobs market and challenges in keeping production lines running at desired capacity levels. Furthermore, year-to-date backlog readings continue to register unprecedented high readings; meaning that a greater proportion of manufacturers this year as compared to any time in at least the last decade are reporting rising month-over-month backlog levels.

Critically, the last 5-months of new orders and production data look strikingly similar to those from early 2018 and may indicate that the manufacturing sector has —or is soon to enter— a new phase of the business cycle. Certainly this phase change will be influenced by unique supply chain and backlog conditions which will complicate any predictions for the future.

.jpg;width=70;height=70;mode=crop)