Housing Permits Highest in More Than a Decade

COVID-19 and work-from-home policies have created demand for new homes in the suburbs at the highest rate since the housing bubble burst and the Great Recession followed.

There were 135,400 housing permits filed in July 2020. This was the highest level of permits since June 2007 and the third-highest since September 2006. COVID-19 and work-from-home policies have created demand for new homes in the suburbs at the highest rate since the housing bubble burst and the Great Recession followed.

Permits filed in July were up 14.0% compared with one year ago, returning to double-digit growth for the second month in a row. Housing permits grew for the 11th time in 13 months, with the only two months of contraction the first two months of the pandemic hitting the U.S. In July, the annual rate of growth accelerated to 7.0%, which made it the 11th-straight month of growth. It was the second-fastest rate of annual growth since May 2018.

The real 10-year Treasury rate, which is the nominal rate minus the rate of inflation, was -0.88%. This was the seventh consecutive month and 10th of the last 12 that the real rate was negative. Inflation was relatively low but increased in the last two months.

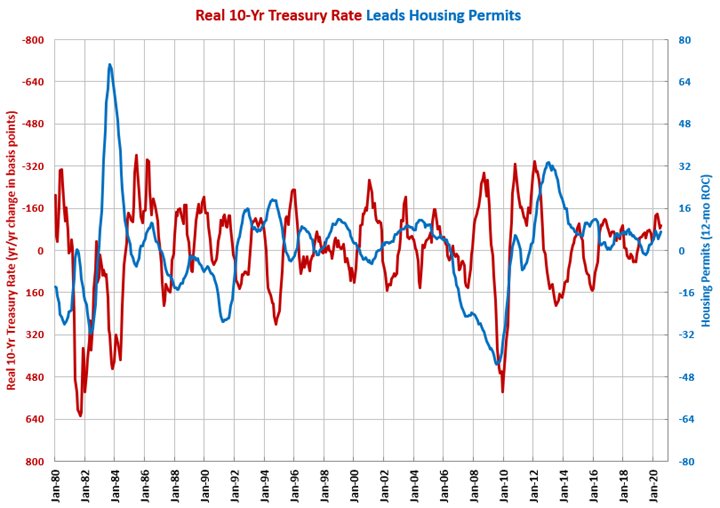

In July, the year-over-year change in the real rate was -96 basis points. The change was negative for the 19th month in a row and slightly more negative than last month. In general, the trend in the year-over-year change in the real 10-year Treasury was moving down (more negative) in the last six years. In order for that trend to continue, the rate of inflation needs to accelerate since the Federal Reserve has stated it has no desire for nominal rates to go below zero.

The change in the 10-year Treasury rate is a good leading indicator of housing permits and construction spending. A decreasing year-over-year change in the real 10-year Treasury rate typically leads to increases in these data points down the line.

.JPG;width=70;height=70;mode=crop)