January Income Increases 11.5%

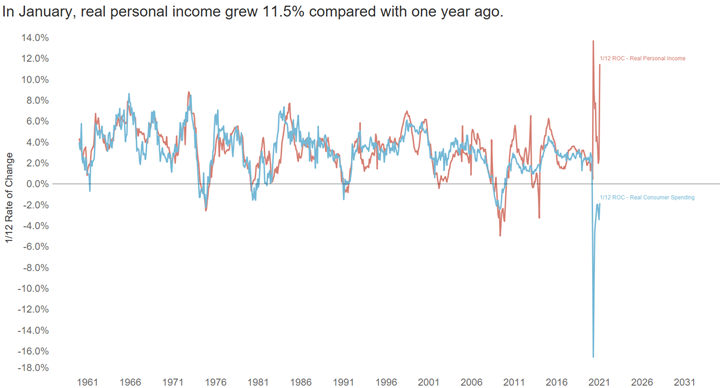

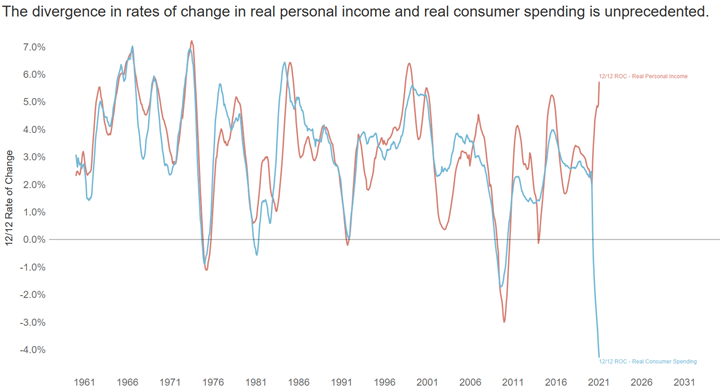

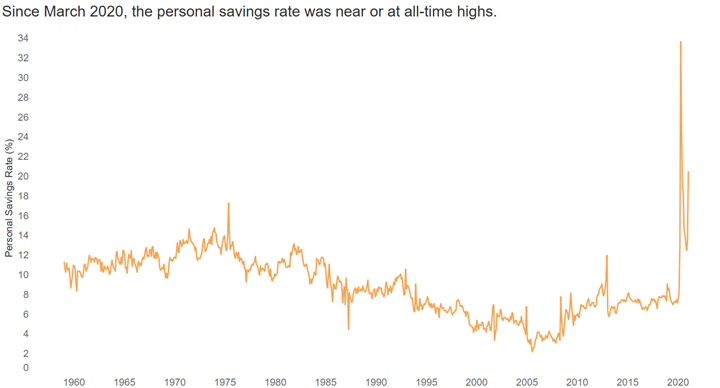

Real personal income jumped dramatically in January on the back of a new round of stimulus checks. Will an eventual reduction in stimulus mean that consumer spending will contract even faster? Perhaps not if the near record high personal savings rate falls to more recent normal levels.

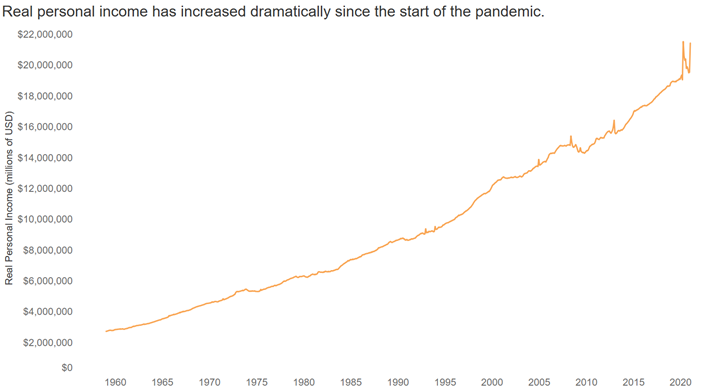

In January, real personal income was $21,453,852 (millions of USD, SAAR). This was almost an all-time high and only eclipsed by April 2020. In spite of, or because of, the economic lockdowns, real personal income shot up dramatically from its 60-year up trend in April 2020. By November 2020, real personal income had returned to its multi-decade up trend. January 2021 resulted in a similar but smaller spike as April 2020.

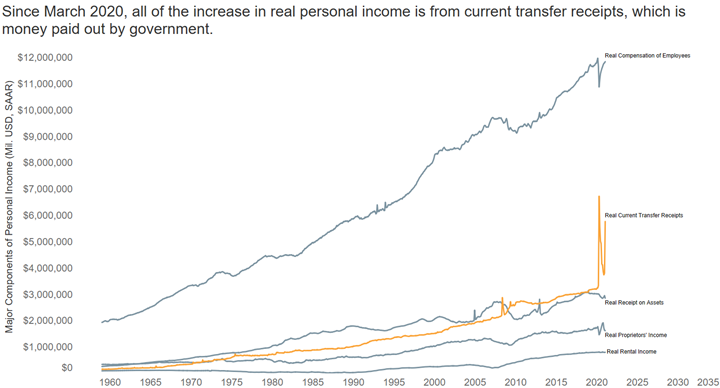

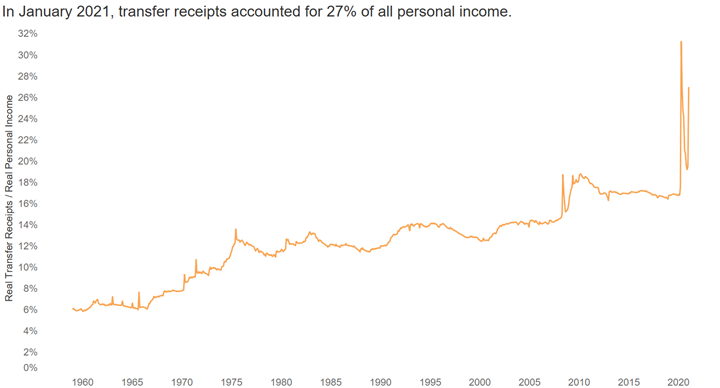

Of course, the spikes in real personal income in April 2020 and January 2021 were not due to earned income as millions of people lost their jobs or had their hours reduced as a result of the economic lockdowns. A look at the major components of personal income shows that all of them are still below per-lockdown levels, except for current transfer payments (e.g. stimulus checks, unemployment insurance, etc.). In fact, current transfer receipts doubled in April 2020 from the previous all-time high. And, they are nearly at that level again as Congress debates further stimulus. Clearly, the stimulus through current transfer receipts is more than the income lost through compensation, dividends and interest, proprietor income, and rental income, which is why personal income spiked so much from the multi-decade trend.

There is some concern regarding what would happen to consumer spending if/when stimulus is eventually removed from personal income. Will consumer spending contract even faster?

.JPG;width=70;height=70;mode=crop)