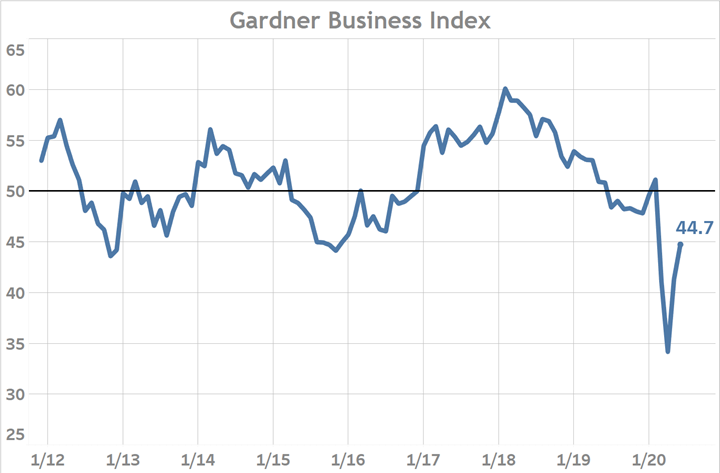

June Gardner Business Index: 44.7

June Survey Registers Second Month of Slowing Decline in Manufacturing

June’s reading of 44.7 brought the Gardner Business closer to a reading of ‘50’ for a second month. Rising readings that are below 50 indicate a slowing rate of contracting business activity. Stated differently, the June data indicate that a shrinking proportion of manufacturers experienced worsening conditions and a growing proportion experienced unchanging or improving conditions relative to May. This situation was also true of May’s results as compared to April’s. Recent activity reported by broad economic indicators of the economy including a rebound in consumption spending and a precipitous drop in weekly initial claims for unemployment since late-March support the impression that the economy is nearing the ‘bottom’ of the decline caused the initial costs brought on by COVID-19.

Gardner’s survey data found several bright spots including the first expansionary reading of overall business conditions as reported by firms between 100 and 250 employees in size. This category of manufacturers reported a strong expansion in new orders and production in June as compared to May. This group also reported a smaller expansion in employment activity. In contrast, backlog and export order activity reported slowing contraction as their results moved higher but remained below ‘50’.

The reading for supplier deliveries as reported by all survey participants continues to decline, indicating that supply chains continue to make progress towards re-normalizing after being severely disrupted in February and March. The latest reading for supplier deliveries returns it to levels that are comparable to the higher end of its historical range. As compared to the supplier delivery reading of June 2018, the latest reading is more than five points lower.

Medical manufacturers responding to our June survey reported a strong expansion in overall activity. The second-best performing market in June was the electronics manufacturing segment which reported nearly no change (‘50’) in total business activity. Most of the remaining end-markets tracked by Gardner reported some level of slowing decline in overall activity for the month.

Gardner Intelligence will do its utmost in the foreseeable future to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to let us know how you are faring. Only through your participation are we able to assess how the industry is doing at a detailed level and where it is heading. We would encourage our follower and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.