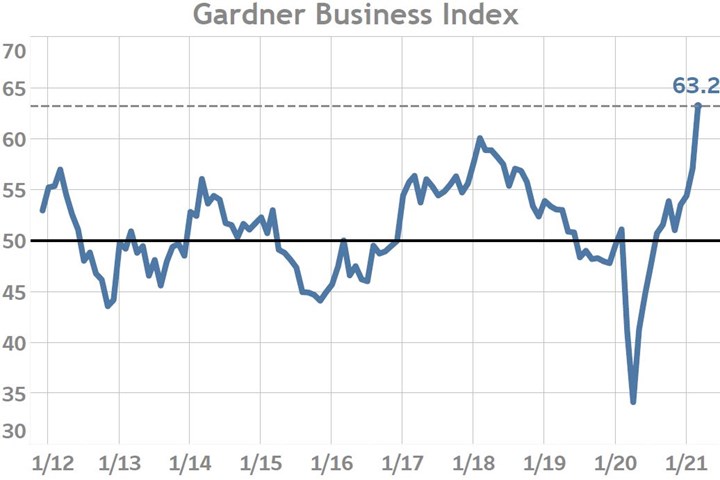

March 2021 GBI: 63.2

Government stimulated consumption over the last year coupled with unprecedented restrictions on global production has driven the intersection of supply and demand into unprecedented territory. Price shocks as reported by manufacturers are being felt both upstream and downstream; it may only be a matter of time before these shocks are more directly felt at the consumer level.

Concerns Over A Business Activity Whiplash Grow

Ending March at an all-time high reading of 63.2, it seems hard to believe that business activity has expanded over the last eight consecutive months at such a rapid rate. This latest all-time high places all previous high readings distantly in the rearview mirror. A 4-point increase in export activity not only drove export activity into expansionary territory for the first time since 2018, but also resulted in an all-time high reading. Of the six measures which constitute the Gardner Business Index, supplier deliveries, new orders, backlogs and exports all registered all-time high readings. Lagging only slightly behind these was production activity which narrowly fell short of breaking its own all-time high.

The Gardner Business Index as of March 2021 set a new all-time high reading driven by supplier deliveries, new orders and backlog activity.

The rise in supplier deliveries activity indicates that an unprecedented proportion of survey respondents are witnessing lengthening order-to-fulfillment times. March marks the fourth consecutive month in which the reading exceeded its pre-Covid high of mid-2018, further, this reading is 14-points above that 2018 high. It can be hard to understand the magnitude of this event, for context one should remember that a reading of 50.0 indicates a “no-change” in month-to-month conditions and that the pre-Covid high was 13-points above this level. At present the supplier delivery reading is over 27 points above the no-change level and from this perspective more than double the prior peak.

The incredible whipsaw behavior of every business activity component over the last year is having -and will continue to have- significant ramifications on the manufacturing sector. There is virtually no corner of the manufacturing sector which is not experiencing rising prices and worsening supply chain conditions. The March reading for material prices -at a reading of nearly 90- indicates that almost all of Gardner’s 500+ respondents to the survey reported rising input costs. By comparison, a much smaller proportion indicated that they were able to pass through their own price increases. The eventual outcome will be either be that manufacturers are compelled to push price increases through for their own products or assume the even more difficult challenge of facing further profit margin compression after having just endured a difficult 2020.

.jpg;width=70;height=70;mode=crop)