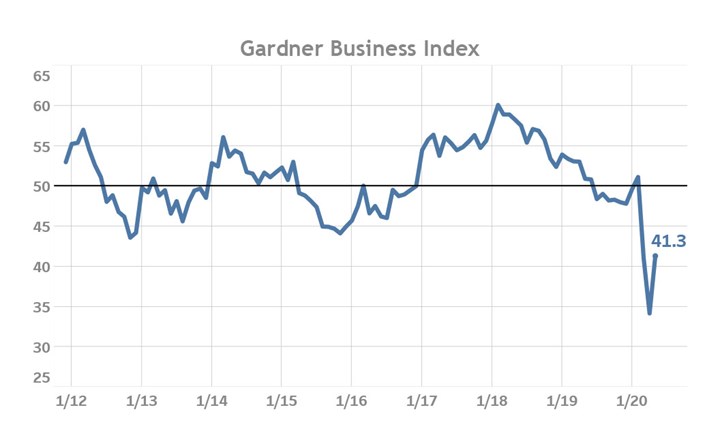

May Data Point to Slowing Decline in Business Activity

Latest reading implies that overall manufacturing business conditions worsened further in May, but at a much slower rate than experienced in April.

May’s reading moved significantly higher from April’s all-time low reading. The latest reading implies that overall manufacturing business conditions worsened further in May, but at a much slower rate than experienced in April. Rising readings that are below 50 indicate a slowing rate of contracting business activity. As the overall economy re-normalizes and more businesses re-open, it is reasonable to expect that the Index will see future months of below 50 readings but overall continue to report higher readings in absolute terms. Among the individual components of the Index, new orders and production both reported 13-point improvements compared to last month followed by substantial increases in the readings for employment and backlogs.

For the first time since the beginning of the COVID-19 crisis in the United States, the reading for supplier deliveries fell. As previously reported, slowing deliveries result in higher readings for this component of the Index. The 4-point decline in the May reading might be an early indicator that the upstream production disruptions experienced in recent months is finally beginning to abate.

Assessing the manufacturing industry by select dimensions, the data indicated that shops between 20 and 49 employees in size reported relatively better business conditions than both their larger and smaller peers. May’s data reported that Gardner’s larger shop size categories reported lower results relative to our smaller size categories. Put in other terms, a greater proportion of large shops reported declining and unchanging conditions than did their smaller peers.

Among the 24 end-markets which Gardner tracks, firms serving the electronics and primary metals markets reported the greatest improvement during the 3-month period ending in May after posting some of the worst results among all end-markets in April. Conversely, after performing relatively better than other end-markets in recent months, manufacturers serving the medical market reported the fastest rate of contracting business activity relative to their peers.

Gardner Intelligence will do its utmost in the foreseeable future to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to let us know how you are faring. Only through your participation are we able to assess how the industry is doing at a detailed level and where it is heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.

.jpg;width=70;height=70;mode=crop)