Monetary Base Continued Strongest Growth Since Depths of 2008-2009 Financial Crisis

Compared with one year ago, January’s monetary base was up 52.4%, which was the fifth month in a row and seventh in the last nine months with faster than 50% growth.

In January, the monetary base was $5.248 trillion, which was an increase from the previous month and the highest level ever. Compared with one year ago, January’s monetary base was up 52.4%, which was the fifth month in a row and seventh in the last nine months with faster than 50% growth. This was the 10th consecutive month that the month-over-month rate of change was faster than 44%. This was the 14th month in a row of month-over-month growth.

The annual rate of growth accelerated to 44.0% in January, which was the 10th straight month of accelerating growth and the fastest rate of growth since April 2010. Based on the monthly and quarterly trends in the money supply, the annual rate of change will contract to accelerate for the first half of 2021.

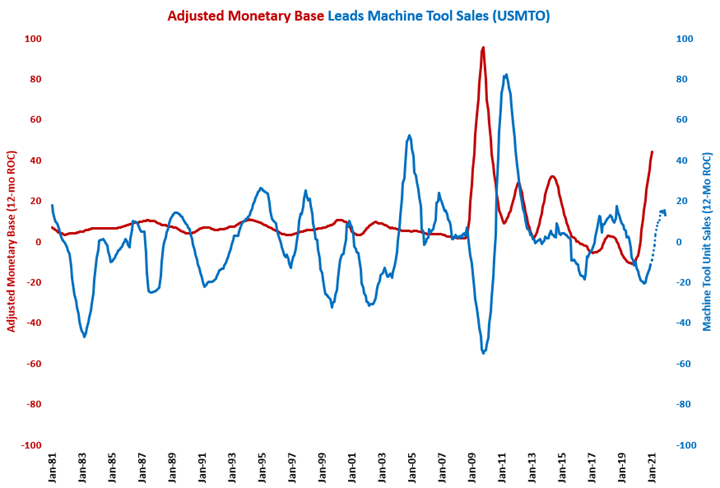

Historically, the annual rate of change in the monetary base leads capital equipment consumption, specifically machine tool orders, by 12-18 months. Although, the lead time between the monetary base and capital equipment consumption shrunk over the last decade. The recent rapidly accelerating growth in the monetary base should eventually lead to accelerating growth in machine tool orders and capital equipment in general. It is likely that machine tool orders bottomed in August. The chart below shows the possible annual rate of change in machine tool orders (dashed blue line).

.JPG;width=70;height=70;mode=crop)