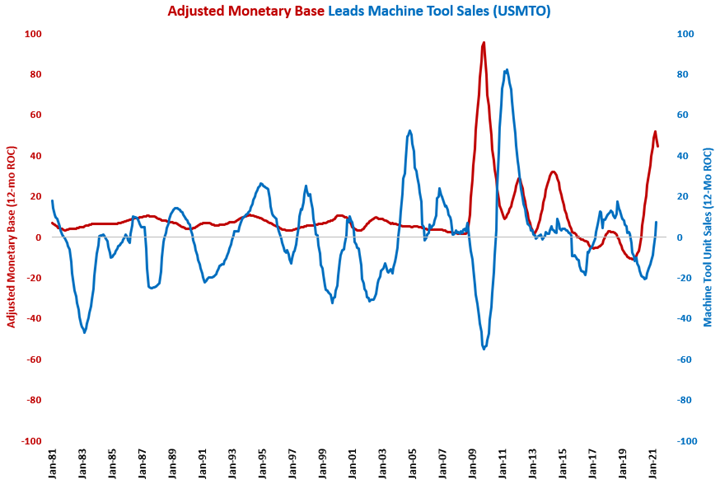

Monetary Base Growth Continued to Decelerate in May

While month-over-month growth is slowing, the recent rapidly accelerating growth in the monetary base should eventually lead to rapidly accelerating growth in machine tool orders and capital equipment in general. That accelerating growth in capital equipment orders should last into 2022.

In May 2021, the monetary base was $6.042 trillion, which was essentially unchanged from last month and the highest level ever. Compared with one year ago, May’s monetary base was up 17.3%, which was the 18th consecutive month of growth. However, it was the third month in a row of decelerating growth and the slowest rate of growth since March 2020.

The annual rate of growth decelerated to 44.4% in May, which was the second consecutive month of decelerating growth. Based on the monthly and quarterly trends in the money supply, it is likely that the annual rate of growth in the money supply will continue to decelerate.

Historically, the annual rate of change in the monetary base leads capital equipment consumption, specifically machine tool orders, by 12-18 months. Although, the lead time between the monetary base and capital equipment consumption shrunk over the last decade. The recent rapidly accelerating growth in the monetary base should eventually lead to rapidly accelerating growth in machine tool orders and capital equipment in general. However, based on the historic correlation, it should be expected that growth in capital equipment orders will peak in the second quarter of 2022.

.JPG;width=70;height=70;mode=crop)