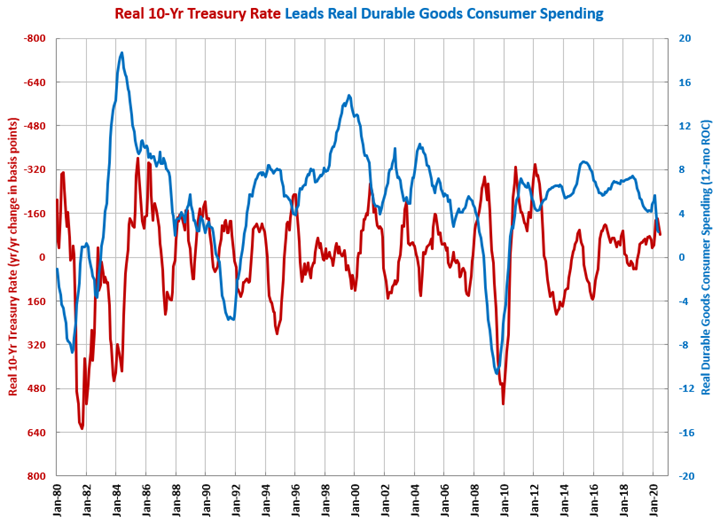

Trend in 10-Year Treasury Rate Positive for Future Spending

A falling change in the real 10-year Treasury rate tends to be a positive signal for durable goods manufacturing.

In June, the nominal 10-year Treasury rate was 0.73%, which was the fourth month in a row and the fourth month ever that the monthly average was below 1%. So, the nominal 10-year Treasury rate has hovered near its all-time lows for four straight months.

The real 10-year Treasury rate, which is the nominal rate minus the rate of inflation, was -0.84%. This was the sixth consecutive month and ninth of the last 11 that the real rate was negative. Inflation was relatively low from April to June compared with the previous four years. However, inflation did pick up significantly in June.

In June, the year-over-year change in the real rate was -83 basis points. The change was negative for the 18th month in a row. However, the change was less negative for the second month in a row. In general, the trend in the year-over-year change in the real 10-year Treasury was moving down (more negative) the last six years. In order for that trend to continue, the rate of inflation needs to accelerate.

As much as the absolute level of interest rates, it is the relative change in interest rates that drives additional borrowing and spending. A falling change in the real 10-year Treasury rate tends to be a positive signal for durable goods manufacturing. Declining changes in the real 10-year Treasury rate tend to lead growth in durable goods new orders and capital equipment consumption by a relatively long period of time – historically, between 12 and 24 months. The longer-term declining change in the 10-year Treasury rate is a good leading indicator of growth in housing permits, construction spending and consumer durable-goods spending as well.

Although, businesses and consumers are tightening their spending due to the COVID-19 pandemic, which means the typical correlation of a lower 10-year Treasury and growth in the above metrics may not occur. And, the nominal 10-year Treasury rate is nearing its lower bound unless the Federal Reserve acquiesces to negative interest rates.

.JPG;width=70;height=70;mode=crop)